Says the net worth of PSUs has touched Rs. 70 lakh crore against Rs. 9.5 lakh crore a decade ago.

NEW DELHI: Public sector undertakings (PSUs) have undergone a significant evolution in the past 10 years, experiencing substantial growth in both revenue and profitability. There are hopes that specific industries will gain further due to the government’s focus on ‘Make in India’ and a heightened capital expenditure.

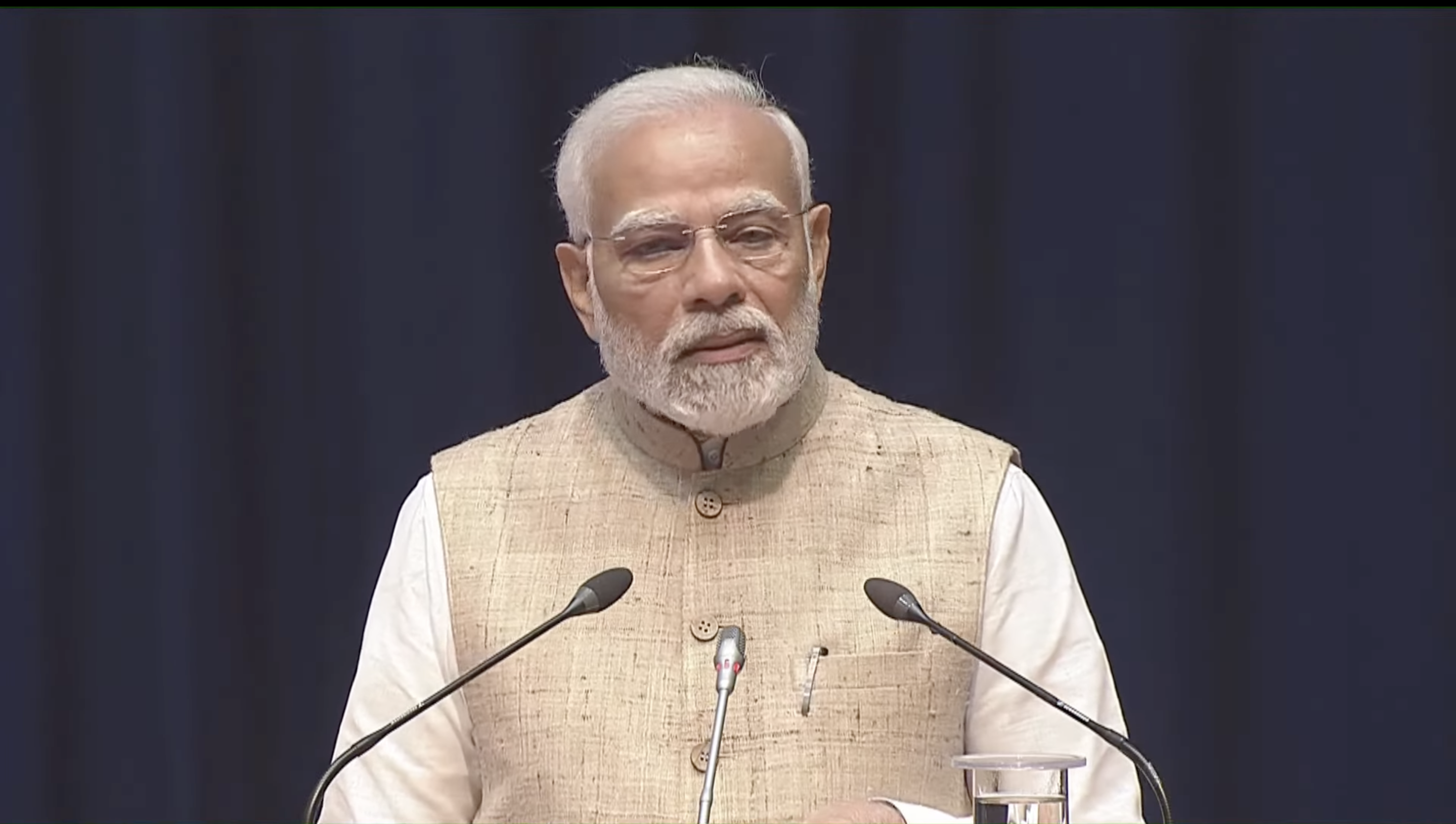

At an event in New Delhi, PM Modi said, “Most of the PSUs have been delivering robust returns to investors due to our effective governance. Investors are now confident in PSUs. Profit of PSUs has surged over 2 times in the last 10 years. The net worth of PSUs has touched Rs. 70 lakh crore against Rs. 9.5 lakh crore a decade ago. You will get such results when you think about the nation first. Companies like Hindustan Aeronautics Limited (HAL) are generating record revenue and insurance behemoth Life Insurance Corporation (LIC) is also getting stronger.”

The PSU sector, once overlooked in the equity market, has delivered lucrative returns since the lows during Covid. The success is attributed to positive advancements in various PSU segments such as power, defence, railways, and banking. The BSE PSU index has gained over 325% from the Covid lows scaled in March 2020, while the benchmark BSE Sensex has rallied 172% during the same period till March 18, 2024.

At least 9 PSUs have delivered over 1,000% returns since Covid lows. With a rally of 2,546%, Fertilisers and Chemicals Travancore emerged as the top gainer on the list. It was followed by RVNL (up 2,121%), Gujarat State Financial Corporation (up 1,759%), Chennai Petroleum Corporation (up 1,394%), and Hindustan Copper (up 1,335%). HAL, Indian Bank, BHEL, and IFCI also gained over 1,000% during the same period.

Public sector banks have seen a remarkable turnaround in financial year 2023-24 - from record losses to record profits - as their aggregate earnings crossed the Rs. 1 lakh crore mark. “Strong earnings recovery is attributed to steady credit growth, significant improvements in asset quality, and stable to positive margins,” Motilal Oswal Financial Services said in a report.

Jammu & Kashmir Bank, Indian Overseas Bank, Bank of Maharashtra, Canara Bank, UCO Bank, Union Bank of India, Punjab & Sind Bank, Central Bank of India, Bank of Baroda, Bank of India, State Bank of India, and Punjab National Bank also gained somewhere between 230% and 920% since pandemic lows.